You have free articles remaining this month.

Subscribe to the RP Witness for full access to new articles and the complete archives.

Reader warning: if you are below the age of 70 ½, or do not have an Individual Retirement Account (IRA), you may file this article under the categories of “boring” and “useless.” However, if you find yourself age 70 ½ or older, and have an IRA, you quite possibly could file this article under the category of “boring yet useful.”

For as much turmoil and uncertainty as there is in the United States, there remain many things for which to give thanks. One of those things is that the Internal Revenue Service encourages citizens to give generously to charitable organizations by providing tax incentives to do so. My hope in writing this article is to share a tax-planning idea that could help reduce your overall tax burden and increase your ability to generously support the many worthy causes in the RPCNA, whether that be your local congregation, RPM&M, presbytery, or denominational ministries.

Significant tax legislation changes were made in late 2017, and many taxpayers are still working through the impact of those changes. One specific change was a doubling of the standard deduction for those filing individually or jointly. While that increase to the standard deduction was a favorable change, it resulted in curtailing the value of itemized deductions, such as the charitable deduction.

To help illustrate this change, consider the following example.

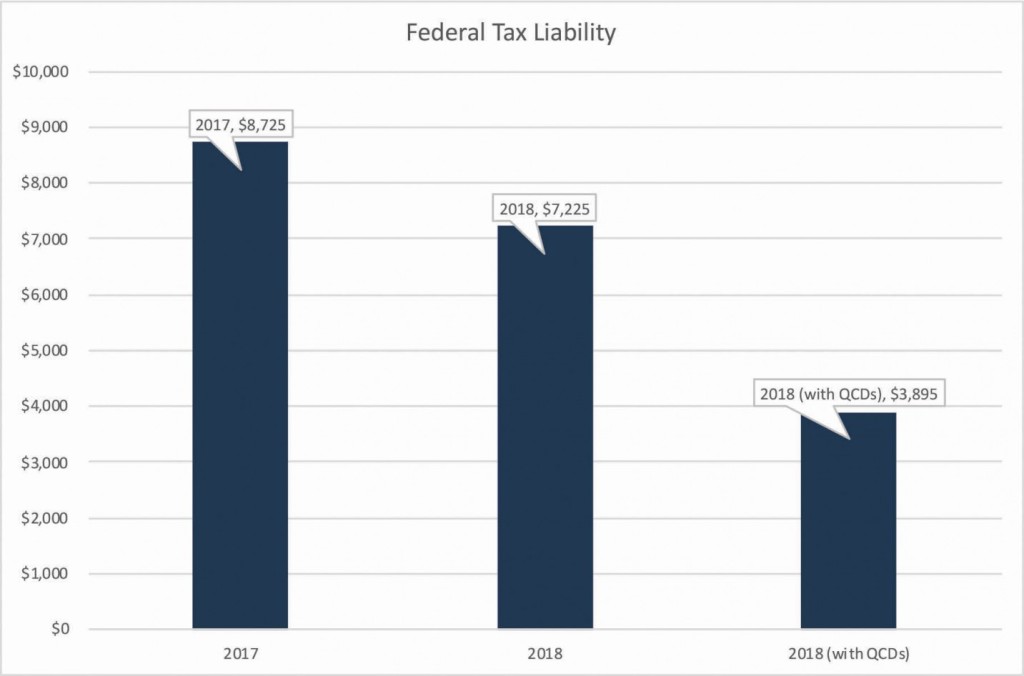

Thomas and Betty are a married couple in their 70s, and their 2017 income tax return showed $40,000 of Social Security benefits, $15,000 of investment income, and $40,000 of required minimum distributions (RMD) from their IRA. During 2017, Thomas and Betty donated $10,000 to their local congregation and $5,000 to their favorite charity (perhaps RPM&M!). Between their charitable contributions, real estate taxes of $4,000, and state income taxes of $4,000, Thomas and Betty had itemized deductions of $23,000. Thomas and Betty’s 2017 federal income tax liability was $8,725. Without Thomas and Betty’s $15,000 of charitable donations, their federal income tax liability would increase by $1,550.

For 2018, Thomas and Betty had the same fact pattern (Social Security, investment income, IRA required minimum distributions, charitable contributions, property taxes, and state income taxes). With the changes from tax reform (primarily due to changes in the tax brackets), Thomas and Betty’s 2018 federal income tax liability was $7,225. However, note that Thomas and Betty didn’t have to itemize in 2018, as their standard deduction of $24,000 (newly doubled with tax reform) was more than their total itemized deductions. Thus, Thomas and Betty received no income tax benefit from their $15,000 of charitable donations made during 2018.

Now, imagine Thomas and Betty took the time to read IRS Publication 590-B (in between reading the Reformed Presbyterian Witness and Gentle Reformation) and stumbled across Qualified Charitable Distributions (QCD) from an IRA.

Under Internal Revenue Code Section 408(d)(8), a qualified taxpayer can have funds (up to $100,000 annually) distributed from an IRA directly to a qualified charity, and no portion of that distribution is included in the taxpayer’s gross income. Taxpayers must be 70 ½ or older in order to make a qualified charitable distribution from their IRA. These QCDs are also counted toward satisfying the annual required minimum distributions. While the SECURE Act legislation that was passed at the end of 2019 did raise the starting age for required minimum distributions to age 72, the qualified-charitable-distribution age remains 70 ½.

Returning to our example, assume Thomas and Betty directed funds from their IRA directly to their congregation and RPM&M (via a qualified charitable distribution) rather than making cash donations. This would result in several things. First, Thomas and Betty would only be required to take distributions of $25,000 from their IRA as a required minimum distribution (after reducing their RMD by the $15,000 QCD). This reduction of $15,000 to their gross income would also decrease the taxable portion of their Social Security benefits, resulting in a $27,750 total reduction to adjusted gross income ($15,000 reduction to RMD income and $12,750 reduction to taxable Social Security benefits). However, note what doesn’t change. First, Thomas and Betty have the same standard deduction of $24,000. Second, Thomas and Betty’s congregation and RPM&M are receiving the exact same amount. Third, Thomas and Betty are in the same cash position in either scenario. Now, let’s consider the impact to Thomas and Betty’s federal income tax—a $3,330 reduction (from $7,225 to $3,895).

This tax benefit is significant, given that Thomas and Betty are in the same cash position, and the charities receive the same $15,000. By using a QCD, Thomas and Betty are now faced with one question: what to do with the $3,330 tax savings? Knowing Thomas and Betty like I do, perhaps they’ll decide to pass those tax savings along to charity.

While the example of Thomas and Betty is somewhat simple, perhaps you’ll find your own tax situation is not too different. Many other people (i.e., those filing taxes as single, etc.) would experience a similar benefit. Utilizing a QCD may very well result in significant tax savings for you, which will allow you to even further increase your generosity. There are certainly situations in which a QCD won’t create a benefit, but it is certainly worth taking a look.

Imagine if 100 readers could each increase their giving by $2,000 per year, without any additional “out-of-pocket” cost, simply by utilizing IRS-authorized methods, how the Lord might use those means to further establish the ministry of the RPCNA!

A Trustees of Synod article is featured semiannually in the Witness.